Car Gst Rebate Period Malaysia

If the late payment relates to an outstanding late-payment penalty relief is provided if 20 of the penalty is paid during 1 May 2021 through 31 August 2021 with relief allowed for the remaining 80 of the penalty. 25032022 0208 AM.

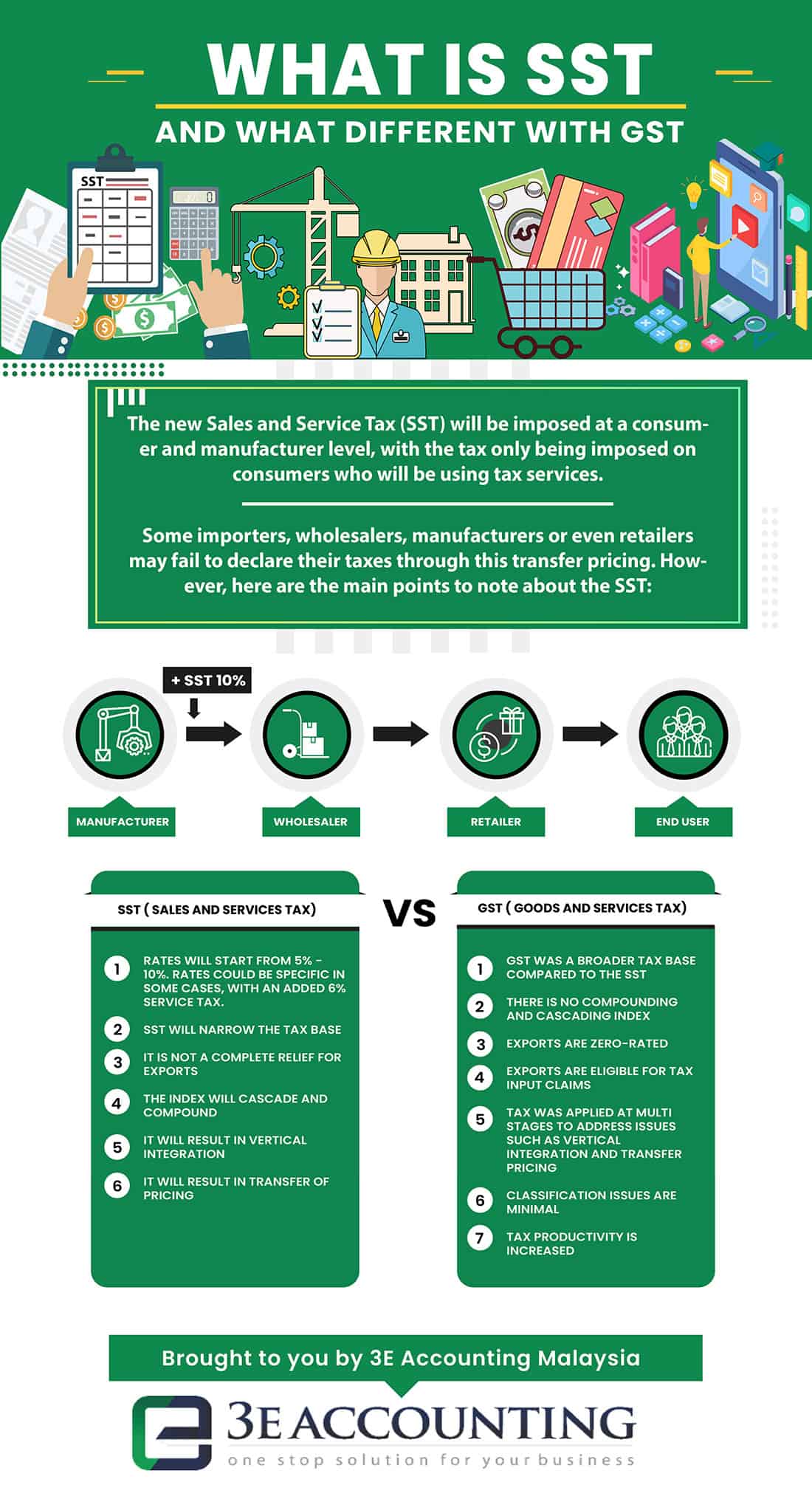

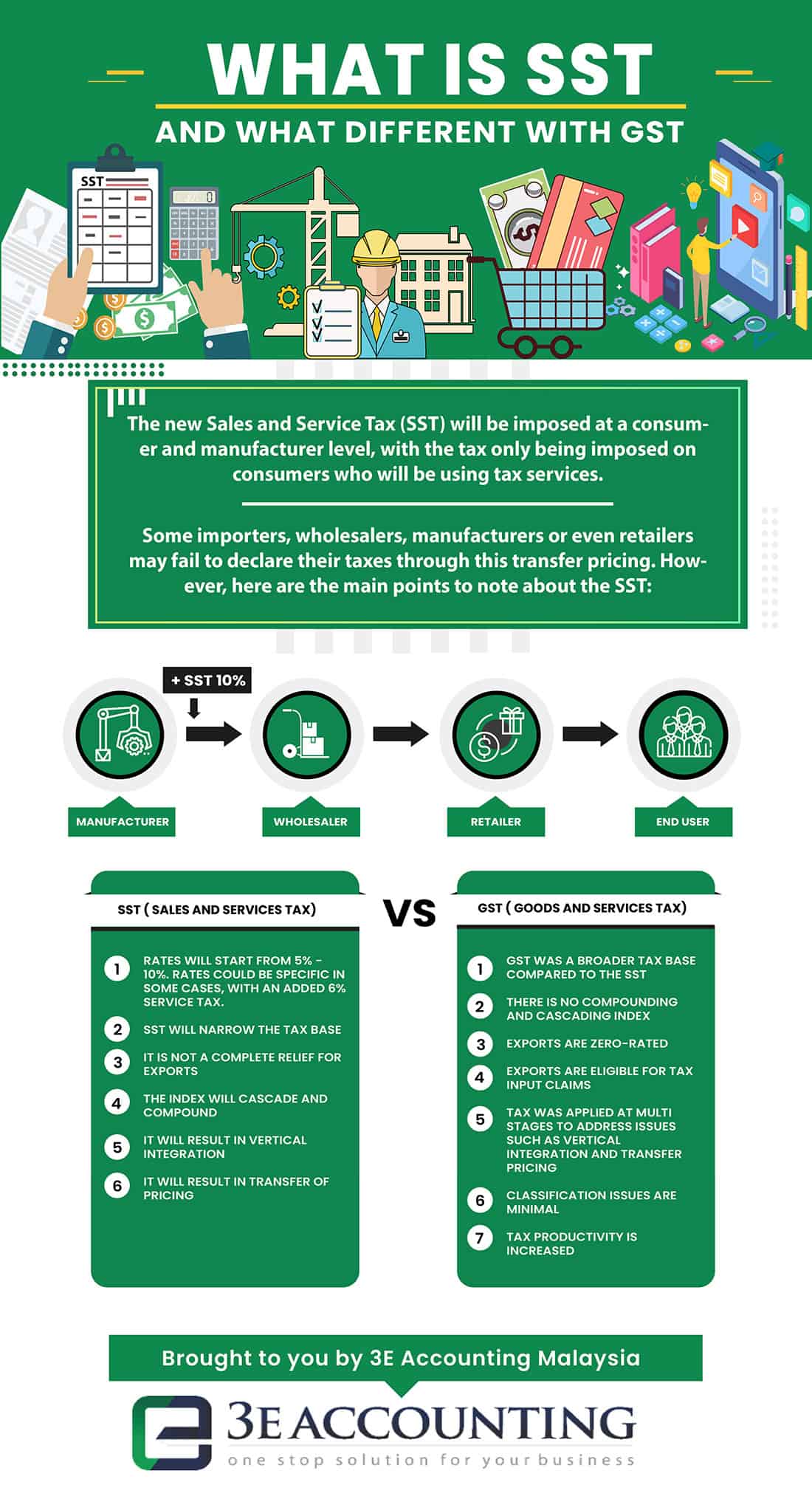

Sales And Service Tax Sst In Malaysia Transitional From Gst To Sst 2 0

To participate in the Tourist Refund Scheme in Malaysia a merchant must-.

. It was replaced with a sales and services tax SST on 1 September 2018. After Pakatan Harapan won the 2018 Malaysian general election GST was reduced to 0 on 1 June 2018. But James used the company car benefits and free petrol for a period of 9 months.

As we mentioned above GST was calculated based on the retail price. Be registered for GST under section 20 of the GST Act 2014 and hold a valid GST registration number. As per our update.

Rebate of RM1000 in the form of e-voucher will be given to the company who purchase the GST Accounting Software. Rather it is based on the cost price of the companys car when it was new which is RM 135000. The BMW iX3 M Sport is going.

BMW i Pricing in West Malaysia. The carmakers are also offering discounts averaging 6 the same amount as the current GST rate. To qualify cars must be registered before 30-June 2022.

Hence the annual prescribed values to James for his use of car and petrol are. The conditions include full payment of GST. 4 years free road tax for EVs from 1-Jan 2022 to 31-Dec 2025.

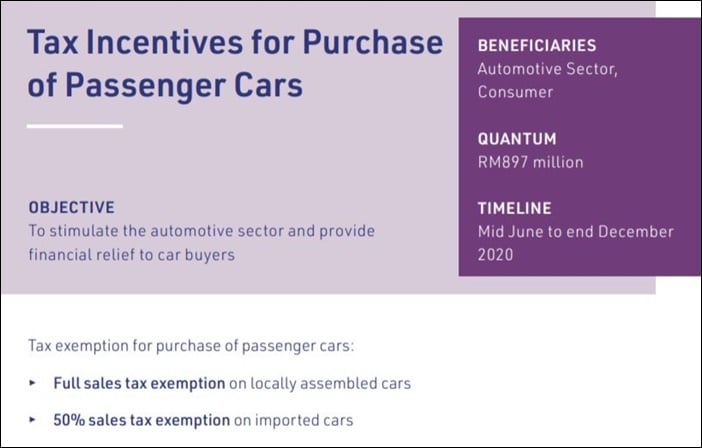

This move comes after the present-day Pakatan Harapan government abolished 6 percent GST until new tax scheme takes effect. Hi Pat GST is no longer charged on all goodsservices in Malaysia after 31st May 2018. The current sales tax SST exemption for locally-assembled CKD passenger cars will expire by 30-June 2022.

The C200 AMG Line which cost RM254888 with GST went down by 598 to RM240501. You should still follow the instructions below to claim any GST paid on purchases made until 31st May. The application for the exemption will begin on 15 February 2022.

Read a June 2021 report prepared by the KPMG member firm in Malaysia. Beyond that the 10 percent SST will apply. The objective of abolishing the GST was to put more purchasing power in the hands of the Malaysian people especially the lower- to middle-income earners.

Meanwhile in Langkawi where cars are sold without import and excise duties the BMW iX is priced from RM313630 which is RM106000 cheaper. Key announcements that are relevant to the Malaysian automotive industry include the extension of the original PENJANA plans SST exemption on passenger vehicles. The government has extended the Sales and Services Tax SST exemption for passenger vehicles for six months until June 30 next year.

Goods and services tax to sales and service tax transition rules. To promote the usage of electric vehicles Malaysia has announced a full exemption for import duty excise duty and sales tax for EVs. Be affiliated by the Approved Refund Agent.

Budget 2022 has been announced in parliament by Finance Minister Tengku Zafrul. Many people believed that GST increased living costs since it was implemented. 1 The then Government of Malaysia tabled the first reading of the Bill to repeal GST in Parliament on 31 July 2018 Dewan Rakyat.

But GST is not calculated the same way SST is calculated. The new prices hold valid from June 1 2018. SST and GST are calculated Differently.

On the 1 June 2018 the new Malaysian government withdrew the Goods and Services Tax GST. Free use of the companys car. In line with the governments allocations under the Budget 2022 the Ministry of Transport Malaysia has announced that electric vehicles EV will be exempted from road tax starting 1-January 2022 to 31-December 2025.

With Mercedes-Benz Malaysia there was also a slightly-less-than-6 decrease in price. The test run for the pilot project relating to the early registration process will be conducted six months before the GST implementation date. Local and foreign carmakers are throwing in an immediate cash rebate of between RM1000 and RM23000 for a brand new car as they trim the on-the-road OTR prices ahead of the zero-rated goods and services tax GST to be implemented in June.

Its the same for Imported CBU passenger cars which although dont enjoy full exemption are now paying a lower 5 percent SST. A tax holiday was declared on 1 June 2018 and the GST rates were reduced from 6 to 0 which was the beginning of the transition from GST to SST. Get rebate RM1000 when you buy GST Accounting Software.

Below is a summary of the points for taxpayers to consider during the transition period. Please note that Malaysias GST has been reduced from 6 to 0 with effect from 1st June 2018. 2 GST was replaced with the Sales Tax and Service Tax starting 1 September 2018.

The new extension will allow carmakers to sell locally-assembled vehicles CKD completely free of the usual 10. Be approved by the RMCD to participate in the scheme. BMW Group Malaysia has revised the prices of MINI cars.

Malaysia May Reintroduce Gst Says Pm Ismail Sabri How Will Car Prices Be Affected Compared To Sst Paultan Org

Gst Vs Sst In Malaysia Mypf My

Sales Tax Exemption On Passenger Cars In Malaysia How Much Will You Save

Gst Reimplementation Could Reduce Malaysian Car Prices Says Analyst But Is That Really The Case Paultan Org

Malaysian Car Sales Expected Up With Gst Abolition Wardsauto

Malaysia Sst Sales And Service Tax A Complete Guide

0 Response to "Car Gst Rebate Period Malaysia"

Post a Comment